Comprehension the fundamentals of Accounting

Accounting is usually a crucial part of any prosperous business. It requires the systematic recording, reporting, and Investigation of monetary transactions. For anybody venturing in to the realm of organization, an idea of accounting principles is indispensable. The field encompasses different procedures that deliver insights into the monetary overall health of a corporation, rendering it essential for informed selection-generating. When you delve into this information, you'll find useful info on the basics of accounting, several different types of accounting expert services available, the difficulties faced in the sector, finest tactics for effective administration, and strategies to evaluate accounting success. By equipping your self with this particular information, you may make additional educated conclusions that should ultimately enhance your monetary method. For more specialized insights, take into account Discovering accounting expert services personalized to your preferences.

Exactly what is Accounting?

At its Main, accounting is the art of recording, classifying, and summarizing monetary transactions to provide insight and information that stakeholders can use to create choices. All organizations, irrespective of measurement, depend upon accounting to trace their income, expenses, and profitability. Through various accounting practices, companies can present a clear picture of their financial stability to investors, regulatory bodies, and administration.

Vital Accounting Concepts

The willpower of accounting is ruled by quite a few vital concepts that assure regularity, trustworthiness, and comparability of economic data. A number of An important ideas contain:

Accrual Basis: Transactions are recorded after they happen, no matter when money modifications fingers.

Regularity: Corporations really should use the exact same accounting approaches and rules during their economic reporting to make certain consistency.

Going Issue: This basic principle assumes that a company will keep on to function indefinitely Unless of course it is revealed if not.

Matching Basic principle: Bills must be matched With all the revenues they help to generate throughout the similar accounting period of time to precisely reflect profitability.

Importance of Accounting in Business enterprise

Accounting performs a pivotal position in enterprise operations. Comprehension and utilizing right accounting actions permits a business to deal with its money overall health successfully. From assessing profitability to checking funds movement and ensuring compliance with economical restrictions, accounting gives the data required to make strategic selections. Furthermore, accurate accounting allows firms recognize inefficiencies and locations that involve enhancement, marketing a culture of accountability and performance.

Sorts of Accounting Companies

Diving deeper into the sphere of accounting, it’s necessary to recognize the various different types of accounting services that companies can choose, depending on their requires and ambitions. Comprehending these distinctions will let you decide on the appropriate company company and optimize your finance administration.

Fiscal Accounting Defined

Economical accounting pertains to the entire process of recording, summarizing, and reporting an organization’s economical transactions in excess of a specific interval. This self-control focuses on giving a clear picture of a firm’s economic performance by normal financial statements, such as the earnings assertion, stability sheet, and hard cash circulation statement. Economic accounting is especially critical for external stakeholders, for instance investors and creditors, mainly because it governs how organizations communicate their functionality and obligations.

Managerial Accounting: A Deeper Dive

Contrary to monetary accounting, managerial accounting is personalized for the internal administration of an organization. It concentrates on offering in-depth economic insights to administrators to assist in conclusion-producing, scheduling, and Handle procedures. Managerial accounting may well contain budgeting, efficiency analysis, Expense administration, and monetary forecasting. By making use of numerous analytical instruments and methods, administration can devise strategies that push the company ahead.

Tax Accounting Techniques

Tax accounting encompasses the techniques and techniques that businesses use to file taxes correctly and successfully. This department of accounting is guided by the Internal Income Code and point out legal guidelines. The target is to organize and file tax returns when minimizing tax liabilities lawfully. Tax accountants help firms navigate complex rules, take advantage of deductions, and guarantee compliance with accounting benchmarks. Audio tax accounting tactics can lead to considerable Price tag cost savings and a far more favorable monetary placement for enterprises.

Frequent Troubles in Accounting

Accounting isn't without its issues. Various obstructions can come up that impede correct money reporting and decision-producing. Recognizing and addressing these worries early on can save firms time and expense, ensuring audio money practices.

Recognizing Monetary Problems

One of the more typical troubles in accounting is human mistake. Mistakes in information entry, calculation, or misinterpretation of economic information and facts can lead to considerable discrepancies and outcomes for businesses. Typical checks and balances, for example reconciliations and audits, may also help identify and correct these kinds of glitches. Implementing robust checks inside the accounting application made use of can minimize the risk of economic problems.

Navigating Compliance Difficulties

Being compliant with ever-evolving accounting requirements and rules is often challenging for companies. Non-compliance can cause critical penalties and harm to a company’s status. Corporations should put money into training and supply their accountants with resources to make sure adherence to these rules. Conducting common compliance audits may help determine places that need to have enhancement, letting providers to adjust their practices as required.

Handling Application Implementation

The quick improvement of know-how usually best site means that companies often face difficulties associated with computer software implementation. Adopting new accounting computer software might be a frightening process, necessitating significant time and methods. It can be important to pick software package that aligns with business enterprise requires and makes certain that all buyers are sufficiently properly trained on its functionalities. Ongoing aid and updates can also be essential in keeping the effectiveness in the accounting operate.

Greatest Methods for Successful Accounting

Employing very best methods in accounting can improve efficiency and precision, bringing about improved managerial conclusions and enhanced fiscal overall health.

Using Accounting Computer software Efficiently

The right accounting application can streamline different accounting processes, decreasing the likelihood of errors and preserving time. These software package not simply manages economic info but additionally offers real-time insights and analytics. It’s important for corporations to on a regular basis evaluate their accounting computer software’s capabilities and update or upgrade as important to leverage new capabilities or enhancements in technological innovation.

Typical Monetary Audits

Conducting regular economical audits can help make sure the integrity of economic details. These audits can recognize discrepancies, make sure compliance with accounting standards, and assess the operational efficiency of monetary procedures. Participating a third party for exterior audits can offer you an unbiased perspective over the small business’s fiscal wellness.

Staying Current with Tax Rules

Tax laws are constantly switching, which makes it important for businesses to remain knowledgeable to make sure compliance and capitalize on opportunity discounts options. Regular schooling periods, attending tax seminars, or consulting with tax experts can equip entrepreneurs and supervisors with the necessary being familiar with to navigate these intricate regulations effectively.

Measuring Accounting Results

Knowing how to evaluate accounting achievement is very important for ongoing small business advancement. Creating essential overall performance indicators (KPIs) will allow firms to determine their money wellness and make data-pushed conclusions.

Crucial Performance Indicators (KPIs)

KPIs function benchmarks that reflect the small business’s overall performance in many places. Common fiscal KPIs consist of:

Web Earnings Margin: Steps The proportion of profitability relative to full income.

Gross Gain Margin: Suggests the efficiency of creation by assessing the distinction between revenue and value of goods marketed.

Return on Investment (ROI): Evaluates the achieve or loss produced from an investment relative to its Value.

Regularly checking these KPIs enables firms to trace their economic development and modify procedures accordingly.

Interpreting Money Reviews

Knowledge monetary stories is crucial for productive choice-generating. Business leaders need to be able to interpret harmony sheets, money statements, and income stream statements to know their corporation’s financial standing. Attaining insights from these reviews can spotlight traits with time, enabling proactive rather then reactive management approaches.

Modifying Approaches for Advancement

Successful accounting consists of continuous enhancement. By consistently reviewing fiscal general performance information and altering procedures, companies can generate actionable plans that foster monetary expansion. This could include scaling functions, chopping expenses, or purchasing new prospects. A society of adaptability ensures that businesses can navigate improvements on the market and stay aggressive.

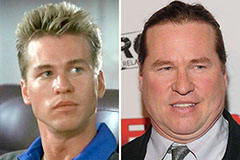

Val Kilmer Then & Now!

Val Kilmer Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Kane Then & Now!

Kane Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!